Would You Purchase Real Estate with a Stranger?

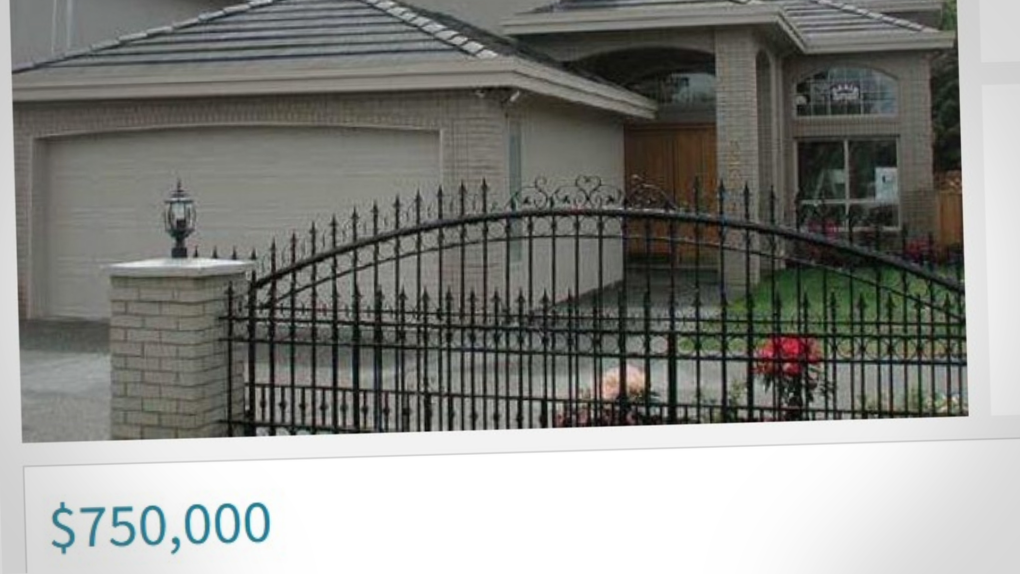

Many prospective buyers may be hesitant at the idea, but an online listing offering “undivided half-interest” in a 2,992-square-foot home in B.C.’s Lower Mainland for $750,000 might make some reconsider.

An Unusual Opportunity

The property on Richmond’s Lockhart Road features five bedrooms, five bathrooms, two fireplaces, and a two-car garage. However, the purchasing arrangement is quite unconventional, as acknowledged by the listing on Realtor.ca. The property description states, “Yes, unusual it is.”

The listing, active for 170 days, encourages potential buyers to do their homework and consider questions like, “Who would I be sharing ownership with?” and “Does the other half want to sell?” The listing emphasizes that they do not have these answers and advises buyers to consult their Realtor for explanations and posted documents.

Shared Ownership on the Rise

While strangers sharing real estate is extremely rare, co-owning property with family members and close friends is becoming more common. Lawyer Richard Bell points to skyrocketing home prices in many B.C. communities as the driving factor. “It’s too expensive for people to buy on their own, so they start looking for sharing opportunities,” Bell told CTV News. “Affordability is a great word, but pretty tough to find it in the major centers, and even the smaller centers.”

Currently, there are no single-family homes in Metro Vancouver listed for less than $1 million, and none of those listed for $1.5 million have five bedrooms and five bathrooms. The Lockhart Road property was most recently assessed at $2.1 million, but whether the asking price of $750,000 for half-interest is an appealing deal depends on the answers to the many unanswered questions posed in the listing.

Considering Co-ownership Arrangements

According to Bell, the key to any co-ownership arrangement is considering as many potential circumstances as possible. For instance, if two couples decide to purchase a home together, they should first agree on what would happen if one of the couples were to separate or move away.

“What happens if someone has to sell? Is there a process where they have agreed, in a contract, to engage in meetings with the new potential buyers? Is there an approval process, like in a co-op situation?” Bell asks. “This is an arrangement where people are committing to something that’s significantly different from what they’ve grown up with, apart from maybe sharing a place when they’re in university, which is a different story.”

Financing Issues

Bell notes that there can be issues surrounding financing. Regardless of how much money each buyer contributes to the down payment, the owners’ names will all be on the mortgage, and the lender will consider each of them 100% liable for the balance.

“Most people will say, ‘OK, I’m going to have a mortgage for $500,000 and you’re going to have one for $750,000.’ But really, you’re both going to be liable for $1.25 million,” explains Bell. Carrying that debt could affect an owner’s ability to finance a new vehicle or even apply for a new credit card.

Shared Ownership: A Path to the Real Estate Market

Despite the potential complications, Bell believes shared ownership can be an excellent way to enter the real estate market. In fact, he shares his home in Vancouver’s Mount Pleasant neighborhood with all of his children under a similar arrangement, which was a dream of his wife’s before she passed away from cancer four years ago.

Bell also serves as the chair of Small Housing, a non-profit organization advising the B.C. government on bringing “gentle density” into neighborhoods primarily consisting of single-family homes. He believes the province’s recent move to reduce zoning barriers in cities, allowing single-family homes to be divided into multiple units, is a step in the right direction. Bell notes that a stratified property can enable each buyer to obtain their mortgage, reducing the potential for difficult situations.

“Co-ownership is a solution that works in a number of situations, stratification would be much better in others,” says Bell. “And we’ll see that unfold over the near future with what the province is doing and what some municipalities are doing.”

Orginal article: Link To Article – provided by Kansas City Realtors

Each Office Independently Owned and Operated

Each Office Independently Owned and Operated