Home Price Increases in Q3: Over 80% of Metro Areas Affected

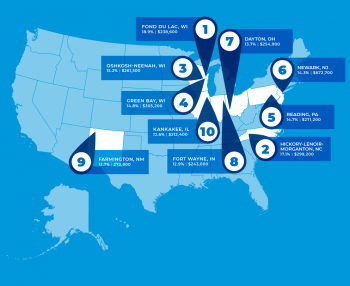

In the third quarter of 2023, more than 80% of metro markets experienced home price gains, with the majority not being luxury homes in the West. The National Association of Realtors (NAR) reported that 11% of the 221 tracked metro areas saw double-digit price increases during this period, up from 5% in the second quarter.

Compared to the previous year, the national median single-family existing-home price rose by 2.2% to $406,900.

Homeowners’ Wealth and the Dream of Homeownership

According to NAR Chief Economist Lawrence Yun, homeowners have accumulated considerable wealth, with a typical homeowner gaining over $100,000 in overall net worth since 2019 and before the height of the pandemic. However, Yun also noted that the persistent lack of available homes on the market would make homeownership increasingly challenging for younger adults unless there is a significant increase in housing supply.

Regional Price Growth

Among the major U.S. regions, home prices grew by 5.3% in the Northeast, 5.2% in the Midwest, 1.7% in the South, and 0.6% in the West. Interestingly, eight of the top 10 most expensive markets in the U.S. were in California, including San Jose-Sunnyvale-Santa Clara; Anaheim-Santa Ana-Irvine; San Francisco-Oakland-Hayward; San Diego; Salinas; Oxnard-Thousand Oaks-Ventura; Los Angeles-Long Beach-Glendale; and San Luis Obispo-Paso Robles.

Conclusion

The third quarter of 2023 saw significant home price increases in over 80% of metro areas, highlighting the ongoing trend of rising home prices. While homeowners have experienced an increase in wealth, younger adults may find it increasingly difficult to achieve the dream of homeownership due to the limited supply of available homes. The real estate industry and policymakers must address these challenges to ensure that the dream of homeownership remains accessible to all.

Orginal article: Link To Article – provided by Kansas City Realtors

Each Office Independently Owned and Operated

Each Office Independently Owned and Operated